Obtain Your EIN Online

An Employer Identification Number (EIN), also known as a Federal Tax ID, is a unique nine-digit number issued by the IRS. It works like a Social Security number for your business whether your a corporation or a DBA and is required for important activities such as:

- Opening a business bank account

- Hiring employees and running payroll

- Filing federal and state taxes

- Applying for business licenses and permits

Why Do You Need an EIN?

An EIN gives your business a legal identity and separates your personal and business finances. Even if you don’t have employees, most banks and vendors require an EIN to do business with you.

With an EIN, you can:

- Establish credibility with banks and partners

- Protect your personal Social Security number

- Comply with federal tax laws

- Keep your business and personal finances separate

Choose Your EIN Package

-

Standard EIN

-

$49

-

Same-Day Filing

-

Priority EIN Processing

-

EIN Letter Included

-

Secure Online Access

-

U.S.-Based Support

-

Guaranteed IRS Acceptance

-

Express EIN

-

$99

-

Same-Day Filing

-

Priority EIN Processing

-

EIN Letter Included

-

Secure Online Access

-

U.S.-Based Support

-

Guaranteed IRS Acceptance

Our EIN Service – Only $49

At Prime Registered Agent, we take the stress out of applying for your EIN. For just $49, our team will:

- Prepare and file your EIN application

- Ensure your business entity details are accurate

- Deliver your official EIN confirmation letter directly to you

✔ One-time fee

✔ No hidden charges

✔ Fast turnaround

Who Needs an EIN?

You’ll need an EIN if your business:

- Has employees

- Operates as an LLC, corporation, or partnership

- Files employment, excise, or alcohol/tobacco/firearms tax returns

- Opens a business bank account

- Withholds taxes on income (other than wages) paid to a non-resident alien

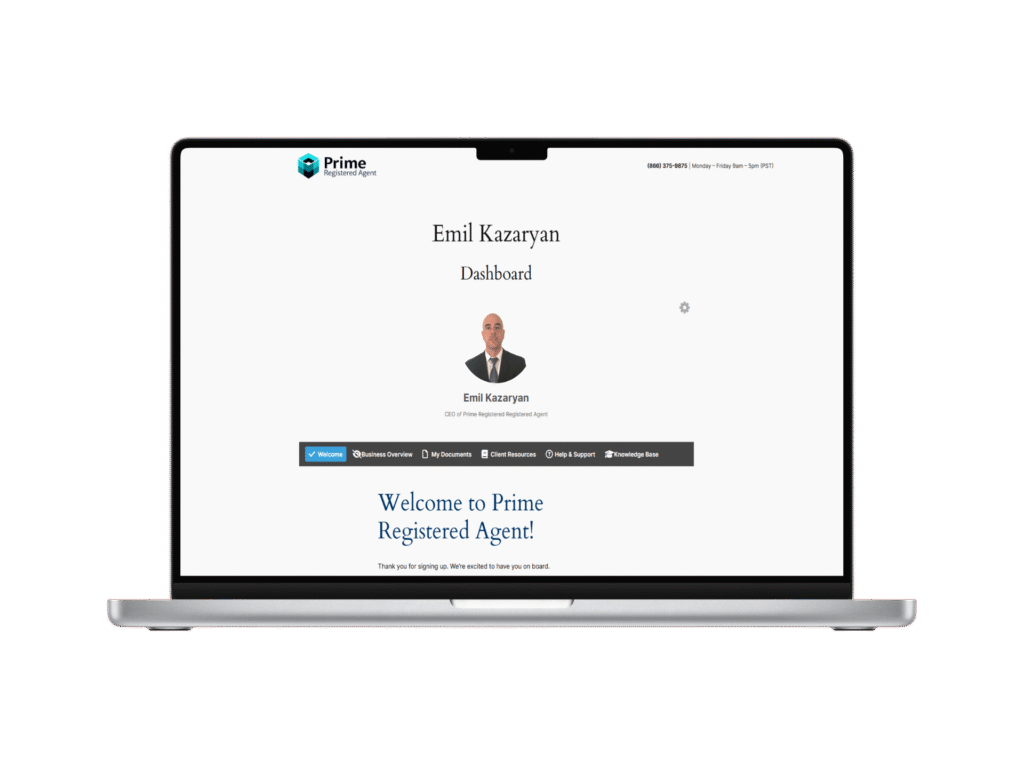

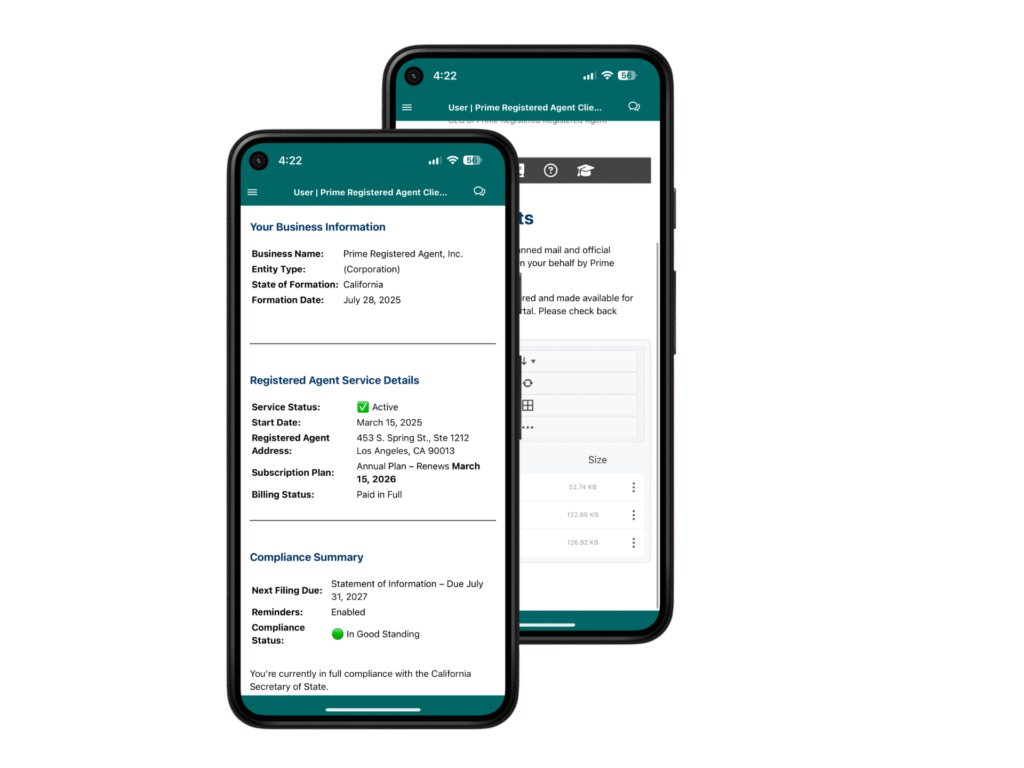

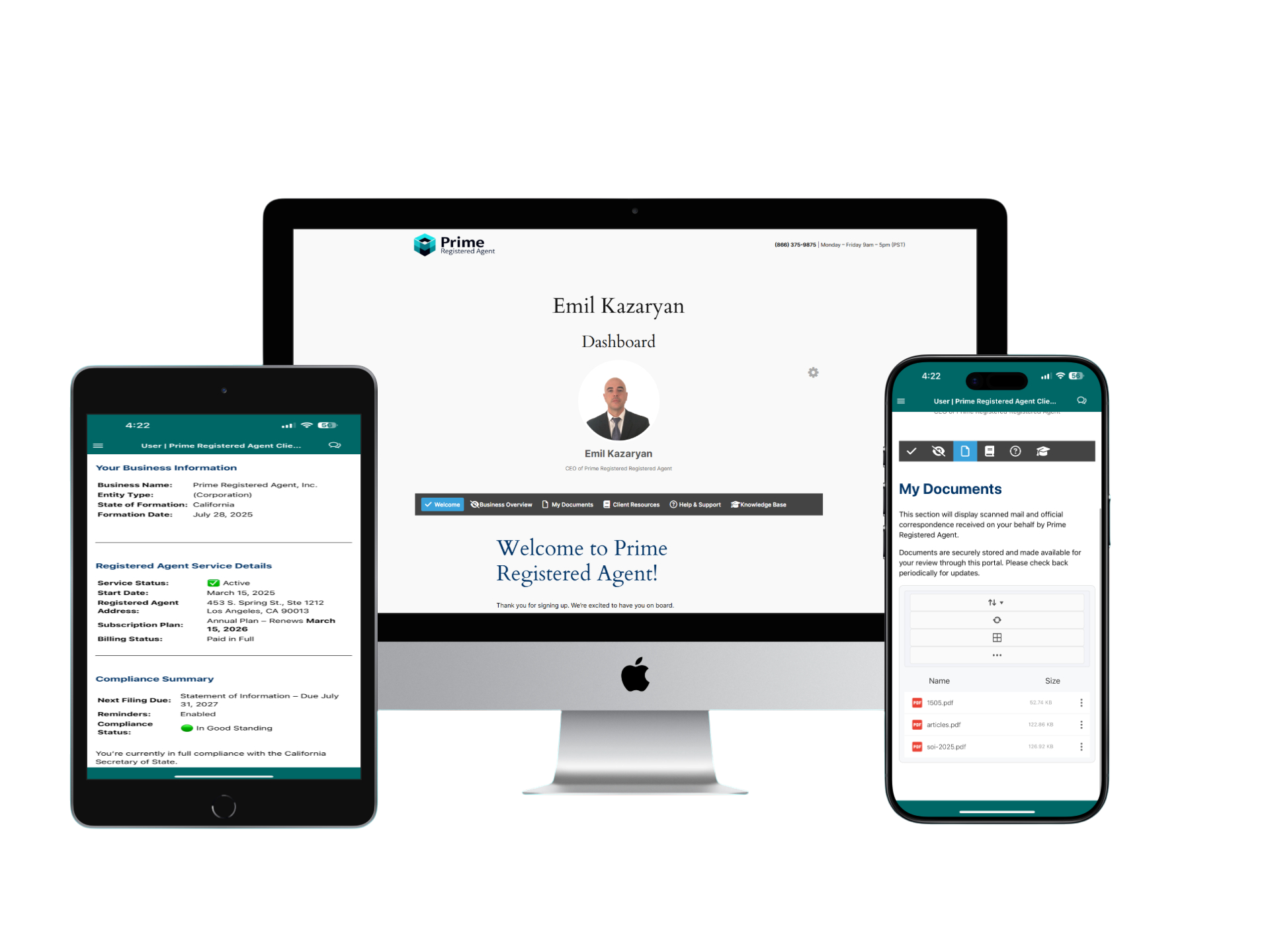

Client Dashboard