File Your Annual Report

File your annual report also known as statement of information (SOI) online now to avoid state penalties. Every corporation and LLC needs to file a SOI with the Secretary of State to stay compliant.

Our service will help you file your SOI with the State to stay compliant and in good standing for a low fee of $99 which includes State fees.

Simple Pricing

-

File Annual Report

-

$99 Includes state filing fees

-

File Annual Report

-

3-7 daysProcessing Time

-

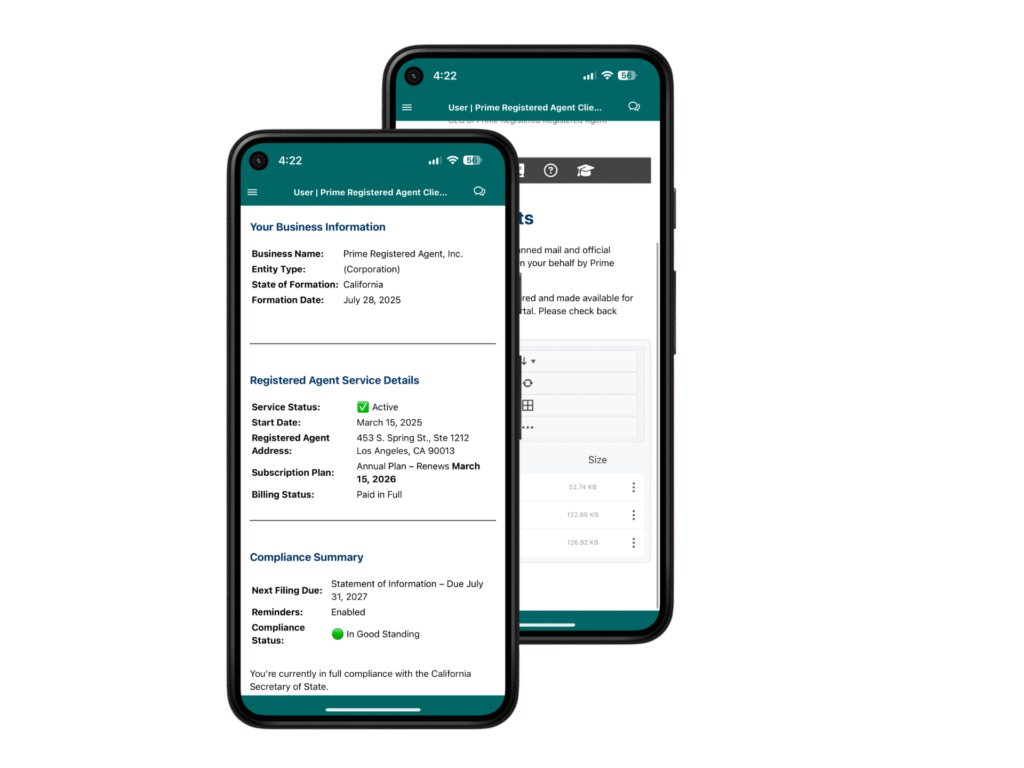

Secure Client Dashboard

-

Digital Document Storage

Annual Report FAQ

Why is a Annual Report required?

Businesses are required to file an annual report to keep their ownership, address, and management details current with the Secretary of State. This helps the state maintain accurate public records and ensures your business stays compliant and in good standing.

How much does it cost to file a annual report?

At Prime Registered Agent, we charge a flat fee of $99, which includes the state filing fee. No hidden fees—just simple, hassle-free filing.

When is a annual report due?

In California, an annual report is due:

- For new businesses: Within 90 days of registering your LLC or corporation.

- For existing businesses: Annually (LLCs) or biennially (corporations), depending on the business type.

Filing on time is important to keep your business in good standing and avoid penalties.

What information do I need to provide?

For your Statement of Information, you’ll need to provide:

- Business description

- Business name & address

- Names and addresses of officers, directors, or members

- Registered agent information (we can serve as your registered agent!)

Can Prime Registered Agent file my annual report for me?

Yes! Prime Registered Agent can file your Statement of Information on your behalf quickly and accurately.

What happens if I don’t file my annual report?

Failure to file can lead to:

- Loss of good standing with the state

- Late fees and penalties

- Suspension or forfeiture of your business