Obtain Your Sellers Permit Online

A Seller’s Permit, also called a Sales Tax Permit, allows your business to legally collect sales tax from customers and purchase goods for resale without paying sales tax. Most states require a Seller’s Permit if you sell or lease tangible products.

Why Do You Need a Seller’s Permit?

Having a Seller’s Permit ensures your business operates legally and avoids fines or penalties. It allows you to:

- Collect sales tax from customers

- Buy inventory for resale without paying tax

- Keep your business compliant with state regulations

One Simple Price

$99

Includes:

✓ Fast 24-48 hour sellers permit submission

✓ Includes State fees

✓ Free Certified Copy

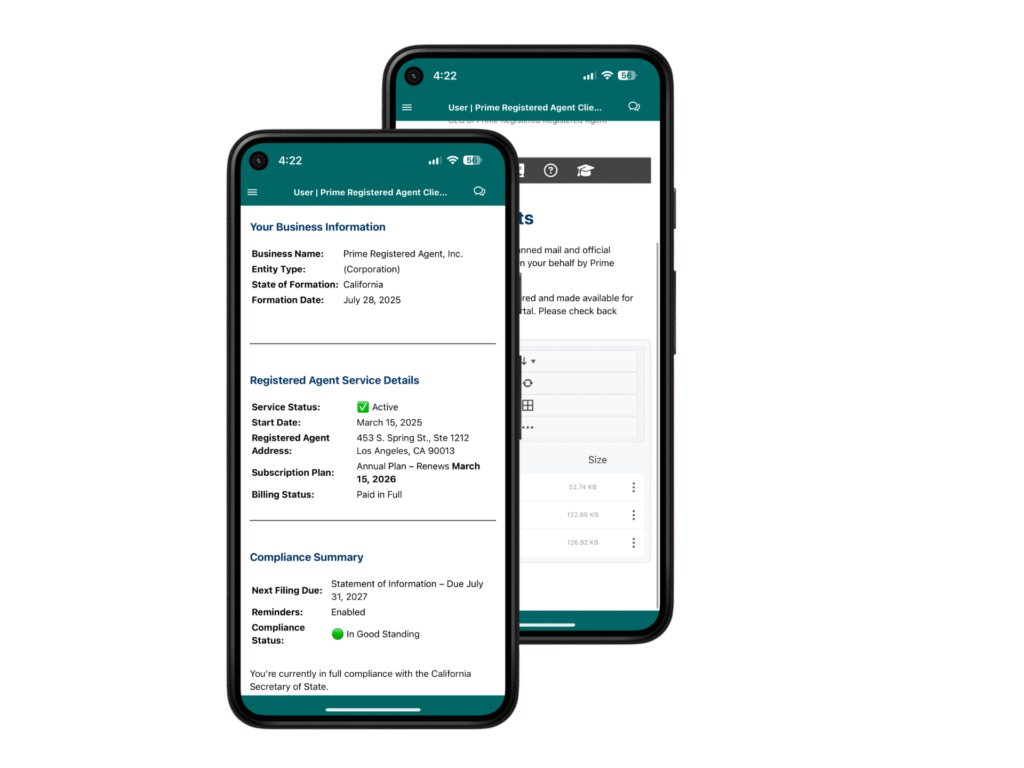

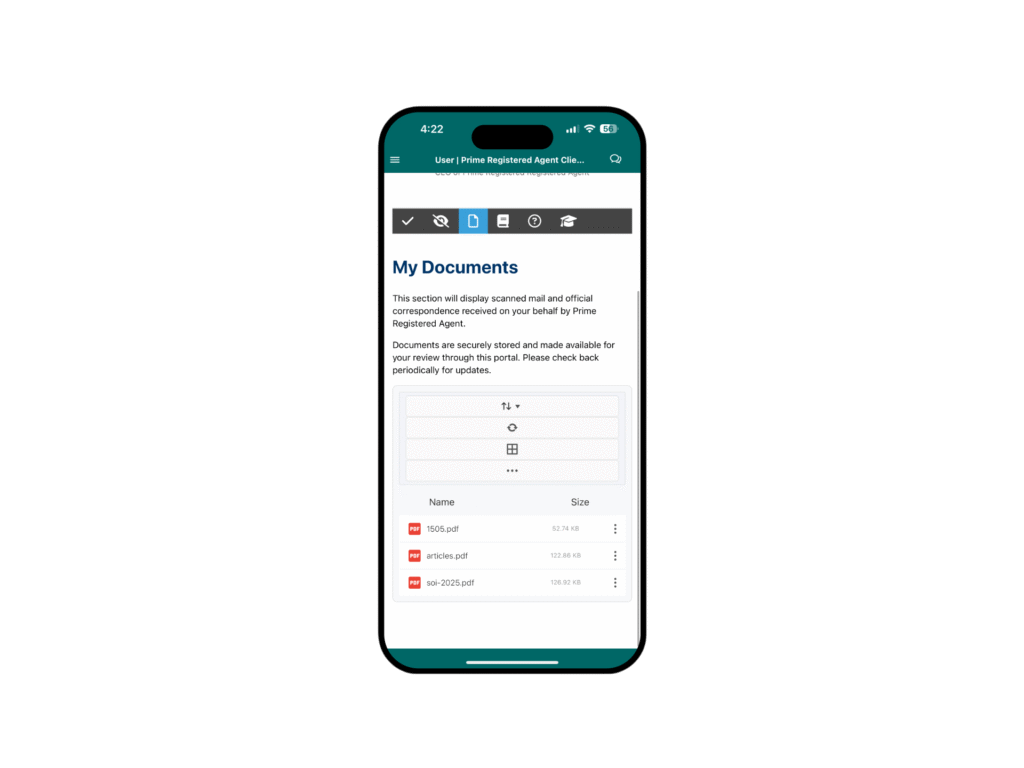

✓ Cloud Document Storage

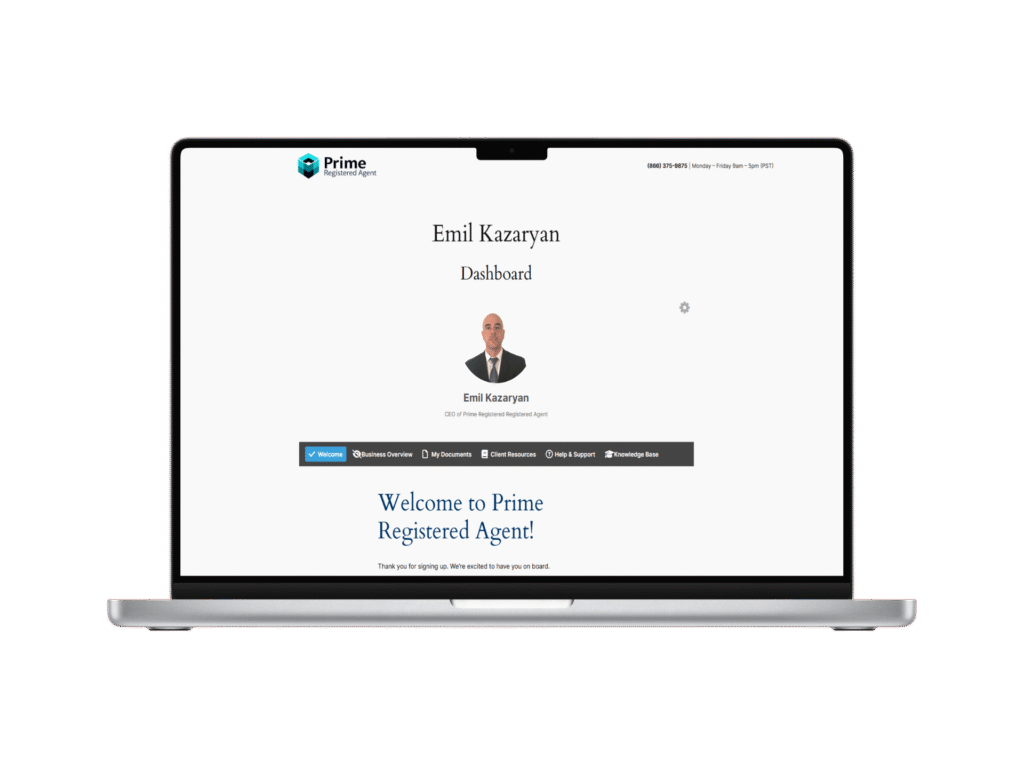

✓ 24/7 Web Portal & Mobile App Access

Our Seller’s Permit Service – Only $99

At Prime Registered Agent, we make the application process fast and simple. For just $99, our team will:

✔ Prepare and file your Seller’s Permit application

✔ Deliver your permit confirmation directly to you

No hidden fees — one flat rate for fast, accurate filing.

Who Needs a Seller’s Permit?

You’ll need a Seller’s Permit if your business:

- Sells physical products online or in a store

- Buys goods for resale from wholesalers

- Operates a retail or food business

Frequently Asked Questions

How long does it take to get a Seller’s Permit?

Do I need a Seller’s Permit if I sell online only?

Do I need both an EIN and a Seller’s Permit?

Request a Free Consultation

Client Dashboard