Form Your Corporation Today

Form Your Corporation online now and get your first year of registered agent service for free. After your first year, the registered agent price is just $45 annually.

Your All-in-One Business Solution

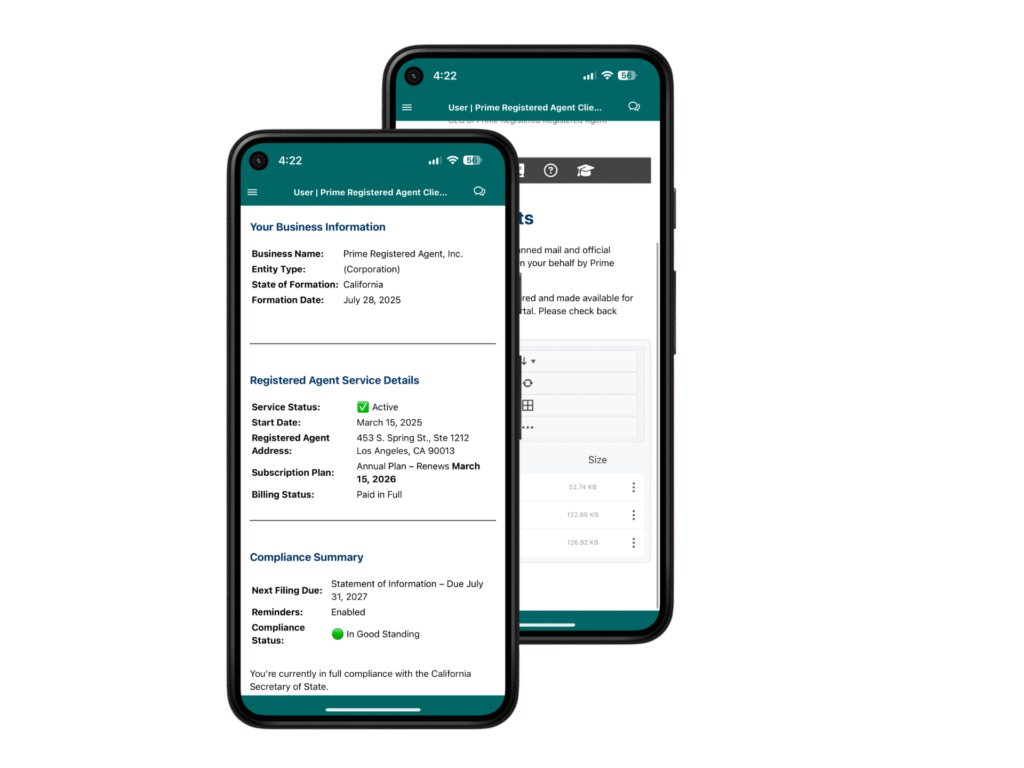

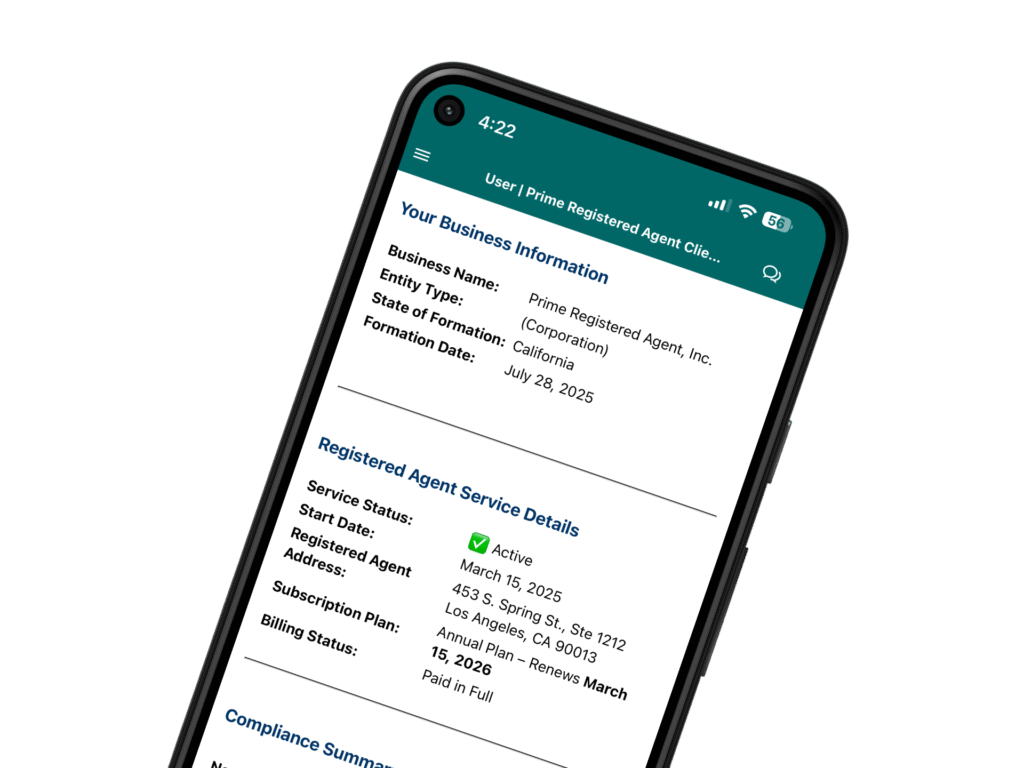

Secure Client Portal

California Business Address

Mobile App

Choose Your Corporation Package

Trusted by Businesses Worldwide. No Hidden Fees. Cancel Anytime.

-

Corporation StarterPay $150 Today – Renews at $45/Year

-

$45 + $105 state filing fee

-

Corporation Filing

-

7-14 daysProcessing Time

-

Registered Agent – 1 Year Included

-

Secure Client Dashboard

-

Entity Management

-

Digital Document Storage

-

Free Business Address

-

Unique Suite Number (PMB)

-

10Mail Scans / Year

-

Corporation + AddressPay $204 Today – Renews at $99/Year

-

$99 + $105 state filing fee

-

Corporation Filing

-

7-14 daysProcessing Time

-

Registered Agent – 1 Year Included

-

Secure Client Dashboard

-

Entity Management

-

Digital Document Storage

-

Free Business Address

-

Unique Suite Number (PMB)

-

50Mail Scans / Year

-

Corporation + PremiumPay $254 Today – Renews at $149/Year

-

$149 + $105 state filing fee

-

Corporation Filing

-

5-7 daysProcessing Time

-

Registered Agent – 1 Year Included

-

Secure Client Dashboard

-

Entity Management

-

Digital Document Storage

-

Free Business Address

-

Unique Suite Number (PMB)

-

UnlimitedMail Scans / Year

Client Dashboard

Request a Free Consultation

Corporation FAQ

What is a corporation?

A corporation is a legal business entity separate from its owners, owned by shareholders. It can enter contracts, own assets, and is responsible for its debts. Corporations offer limited liability protection and have formal management structures, making them ideal for larger businesses or those seeking investment.

What are the benefits of forming a corporation?

- Limited liability protection for owners

- Ability to raise capital by issuing shares

- Potential tax benefits

- Increased credibility with customers, vendors, and investors

What’s included in your Corporation Formation package?

- Preparation and filing of Article of Incorporation documents

- Name availability check

- One year of Registered Agent service ($45/year after the first year)

- Support from our expert team

Do I need a Registered Agent?

Yes, most states require corporations to have a registered agent to receive legal and official documents on behalf of your business.

What’s the difference between an LLC and a Corporation?

An LLC is a flexible business structure with simpler management and pass-through taxation, ideal for small businesses. A Corporation is a more formal entity with shareholders, stricter rules, and can face double taxation unless it’s an S-Corp. Corporations are better for businesses seeking investors or going public.